Market overview H1-2025

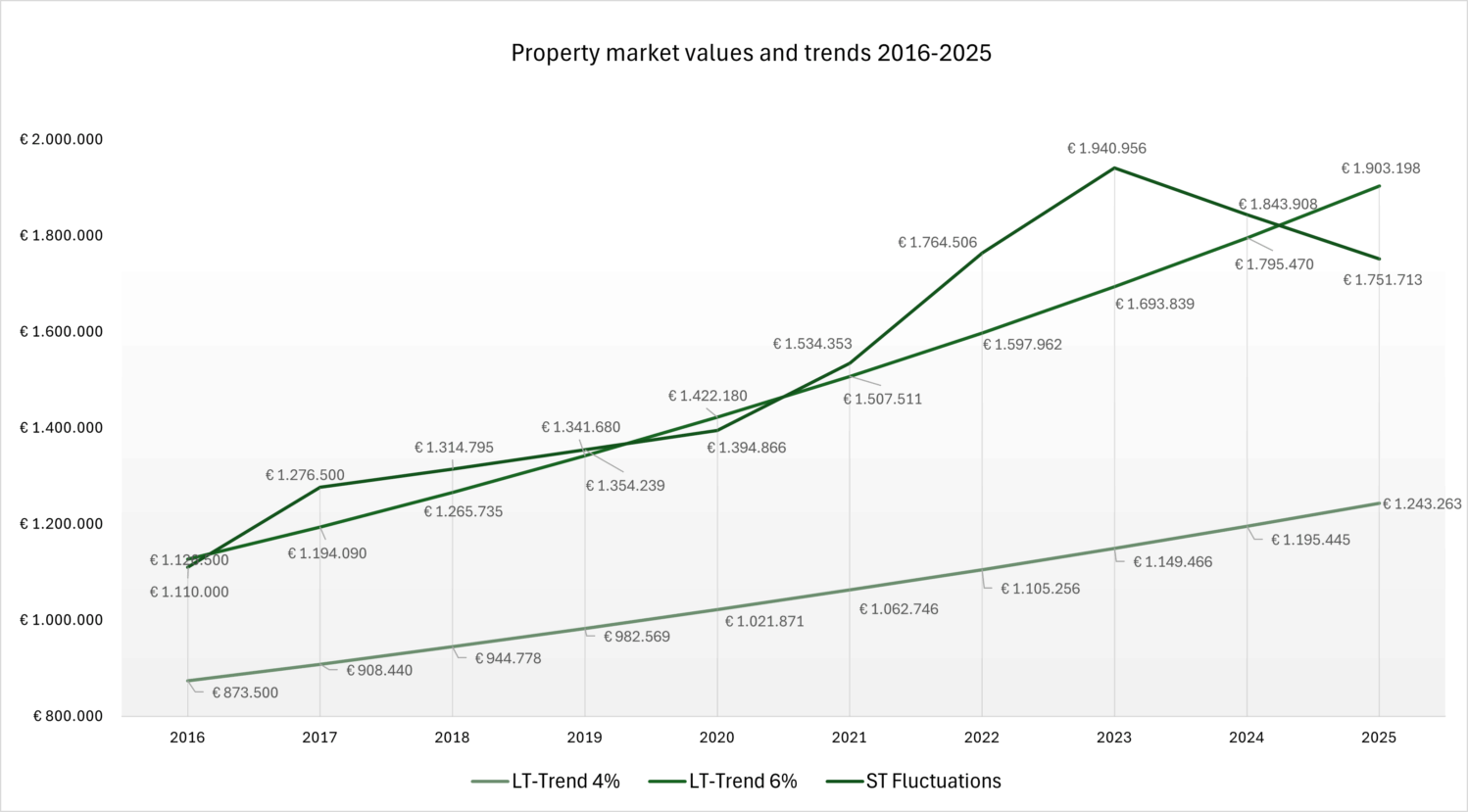

The 20-year trend shows that prices have increased by 4-6% annually. I’m excluding the pre-2002 period, when prices were in pesetas, to keep things simpler. A home that sold in 2002 for €500.000 would now be worth somewhere between €1.250.000 and €1.750.000, depending on location and condition.

Looking at just the past decade, we’ve seen two clear peaks in the number of homes sold: one in 2017 and a more significant one between 2021 and 2023.

After the pandemic, prices skyrocketed. Buyers purchase almost anything that offer space to breathe, enjoy the outdoors, and improves quality of life. Sellers capitalized on this demand, creating a sort of “boomerang-effect”; each new listing came with a slightly higher price tag. This continued until late 2023, when buyers began to resist the upward trend.

So, when we hear that “prices are going down,” what we’re really seeing is a market correction, a return to the long-term growth trend. If you bought a home in 2021 or 2022, you probably won’t see a much higher resale value yet apart from earning back the purchase cost. Still, most buyers purchase a home to enjoy with family and friends over the long term. There’s no need to panic. Prices are expected to keep rising. If you're looking to buy, this may be a good moment.

Current pricing status

So yes, there is currently a slight correction in the real estate market. However, I wouldn’t say that prices are truly going down unless short-term fluctuations drop below the long-term growth trend of 5–6%. (While prices are adjusting from post-corona highs, they remain within or above the long-term growth trend. So, it’s a correction, not a decline.

Tax policy proposals (What about this tax of 100% for non-EU buyers)?

One of the more controversial ideas heard recently is the introduction of a 100% tax on property purchases by non-EU buyers. This would primarily affect British citizens, currently the largest group of foreign buyers in Spain. EU-residents would be exempt.

The proposal is part of a broader, and increasingly urgent, political push led by Prime Minister Pedro Sánchez to tackle one of the biggest social crises Spain has faced in decades: the housing crisis. Ibiza, where the housing market has gone out of control, is often cited as the worst-case scenario and, a warning for what could happen elsewhere in Spain.

Some of these proposals appear thoughtful. Others feel more like a political panic response—and some are being dismissed outright as they are not legal or too harmful for the economy.

Is the 100% Tax a Serious Plan?

The idea of a 100% tax on property purchases by non-EU buyers hasn’t become law, but it keeps showing up in political discussions and the media. In my opinion, this kind of proposal is mainly meant to keep the housing crisis in the spotlight, rather than something the government truly plans to enforce. It’s also unclear whether this kind of tax would even be allowed under European Union laws.

At the heart of the problem is this: for many years, Spain didn’t invest enough in public housing. Now, instead of fixing that with proper long-term planning, some politicians seem to want foreign buyers to help pay for past mistakes.

Also, many experts in this field argue as well that introducing this tax wouldn’t even solve the problem. 3% of the total property purchases are made by non-EU buyers. The type of property they buy is not the typical type of property residents would buy. The effect would be that the second-home market would slow down, and that the social-home-seekers wouldn’t even see an effect.

The European Union is getting involved with taxes

On 18 June 2025, the European Commission formally launched an infringement procedure against Spain, citing that its Non‑Resident Income Tax (IRNR) unfairly targets non-resident property owners. Spanish residents aren’t hit with this tax for owning their homes. That’s what the Commission calls discriminatory. Brussels has given Spain two months to amend the rule or present a solid legal justification. Will keep you updated on this one...

The core of the housing crisis

Spain has one of the lowest amounts of social housing in Europe. Only about 2,5% (some sources even speak of 1,5%) of all homes are social housing. In comparison:

- France has 14%

- The Netherlands has 34%

This is a big problem in places like Ibiza, where there’s a lot of interest from international buyers but not much land. The demand pushes prices up, and there's very little support for local people.

Chasing a minimum goal based on estimated need should be the first step to solve this. However, having a goal and getting to the point of reaching the goal brings some challenges in the political and bureaucratic landscape of Spain (and the Balearics).

An expert view on the situation

Ignacio Escolar is a well-known Spanish journalist and director of the news site eldiario.es. He often speaks about the housing crisis in Spain. According to him, there are three big reasons why the situation has become so bad:

- In the past, the government gave a lot of help to people buying homes. This allowed older generations to build wealth.

- But at the same time, they didn’t invest in public housing, so younger people are now struggling to afford a place to live.

- Land has been treated more like a way to make money than a way to build homes for people who need them.

Whilst this is a general development for the whole of Spain. Heavy tourist and second-home markets see problems amplified.

To fix this, Escolar says Spain needs to take three important steps:

- Change the planning rules so that landowners can’t block new housing projects or drive up prices by speculating.

- Speed up the approval process. Cut down on delays and paperwork so homes can be built faster.

- Build more public housing. Build more affordable homes to help balance the market and support people who are being priced out.

If we just apply this “solution” to the market in Ibiza, we could say that the local government has made progress on step 2. Urban-planning processes are being accelerated and there is progress on that side. However, step 1 and step 3 are lagging. For step 1, unfortunately, planning still often serves private speculation over public housing needs. But the biggest bottleneck comes from Step 3. Despite plans requiring 50% new buildings to be affordable or social housing and 15% ceded to municipalities, actual progress is slow. And, even with housing decrees, significant units continue to be directed to private sales rather than fully public stock.

Please find here a list of a few other proposals to contribute to improvement of the housing situation in Spain, in general. Some of them revoked instantly, some of them part of ongoing discussions:

Conclusions

Yes, the idea of a 100% tax on property purchases by non-EU buyers is real, it’s being seriously discussed. But whether it will happen is very uncertain. There are major legal concerns about whether such a law would be allowed, and public debate is growing, with many strong arguments against it.

Furthermore, the open (or free) market and the public/social housing market should be seen as two different markets. Policies aimed at the luxury or second-home segment don’t automatically solve problems in the affordable housing sector. Just because a law targets high-end buyers doesn’t mean it will improve access for residents .

As for property prices, we’re currently seeing a market correction . After the sharp rise in recent years, prices have begun to settle. At the same time, the number of transactions is rising, which may suggest that buyers see current prices as more reasonable and are feeling confident enough to (re-)enter the market.

In short: the market is adjusting, not collapsing. And, while political proposals make headlines, the real long-term solution lies in building more affordable homes and making smart, well-planned investments in public housing.